Key Takeaways

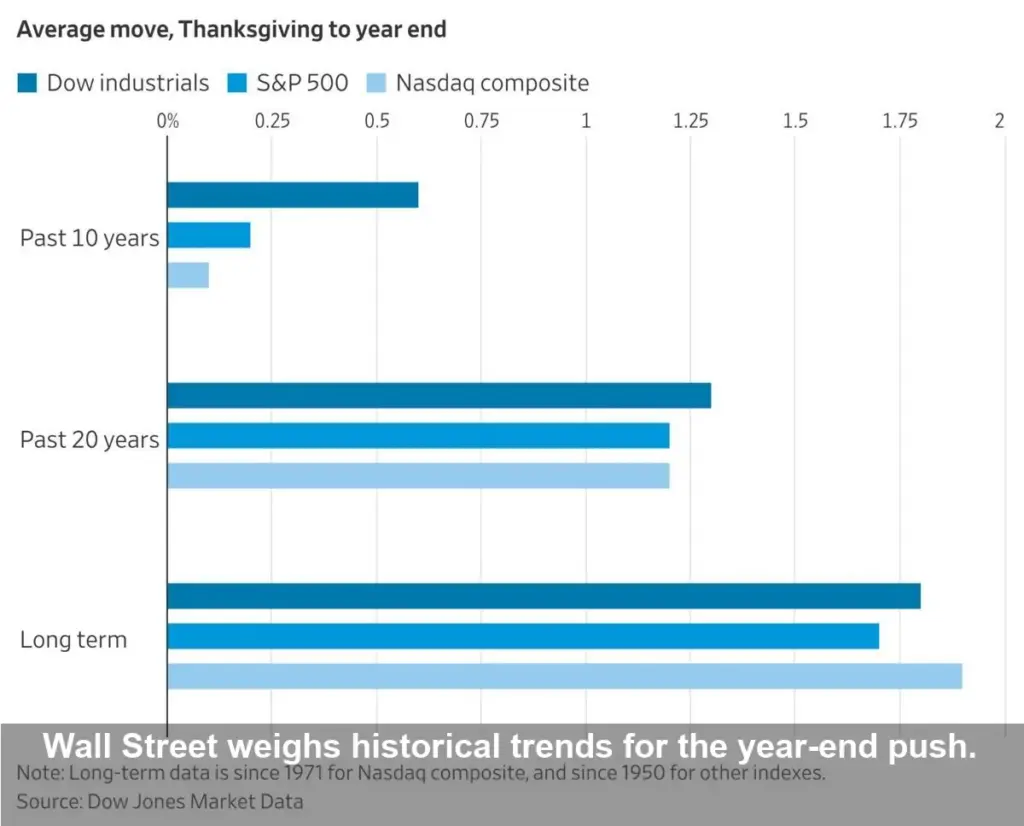

- Historical Trend: Major stock indexes have historically shown a tendency to rise in the period between Thanksgiving and the end of the year.

- Recent Weakness: This pattern has become less reliable in recent years, with average gains shrinking.

- Notable Exceptions: The market experienced significant year-end selloffs in 2015, 2018, and 2022, challenging the traditional “Santa Claus rally.”

- This Year’s Start: The post-Thanksgiving period began with modest gains for the major indexes in a shortened Black Friday session.

With the Thanksgiving holiday behind us, investors are now focused on the final and often most pivotal stretch of the trading year. Historically, this period has been marked by a festive upswing in the markets, but recent performance suggests that a year-end rally is no longer a certainty.

The Hope of a “Santa Claus Rally”

For decades, Wall Street has often celebrated a phenomenon known as the “Santa Claus rally.” According to Dow Jones Market Data, the period from Thanksgiving through the end of December has traditionally been a strong one for stocks. This bullish trend is often attributed to a combination of factors, including holiday optimism, increased consumer spending, and the use of year-end bonuses to invest in the market. Many traders historically look forward to this period as a time when portfolios tend to grow.

A Trend Losing Its Cheer?

Despite the positive historical data, the reliability of this year-end surge has come into question. The good news is that the trend of rising indexes still holds true more often than not. The bad news, however, is that the average gains have become significantly smaller in recent years.

More importantly, there have been several notable exceptions that have given investors pause. The market bucked the festive trend and ended the year with significant selloffs in 2015, 2018, and most recently in 2022. These downturns serve as a stark reminder that past performance is not a guarantee of future returns. As investors watch to see what happens when the stock market opens each morning, the larger question is whether historical optimism can overcome recent volatility.

This Year’s Post-Holiday Kickoff

This year’s trading session following the holiday started on a cautiously positive note. In a shortened session on Black Friday, the three major indexes posted modest gains between 0.5% and 0.7%. While a single day’s performance is not a predictor for the entire month, it sets a mildy optimistic tone as Wall Street heads into the final weeks of the year. Investors will now be watching closely to see if that momentum can build into the sustained, traditional rally of years past or if modern market pressures will chart a different course.

Image Referance: https://www.wsj.com/livecoverage/stock-market-today-dow-sp-500-nasdaq-12-01-2025/card/after-thanksgiving-how-do-markets-typically-perform–rUkzuP9FHfhfLWaBAoZk?gaa_at=eafs&gaa_n=AWEtsqdr5cAV5RZta2Jvf4jVjr9mLggnFyUlFGd-eDmrA6CMiLF_md6WiqOd&gaa_ts=692da975&gaa_sig=p9S9wXNt65Odzj0ZanshaaDTsd-OW-N-SFg1hkywWIfnfBOGqcugK-iO5bAt7B2krNbuMt3Ghnw-g6Jm32fS3g%3D%3D