- The Department of Education announced a proposed settlement that would terminate the SAVE student loan repayment plan, affecting more than 7 million borrowers.

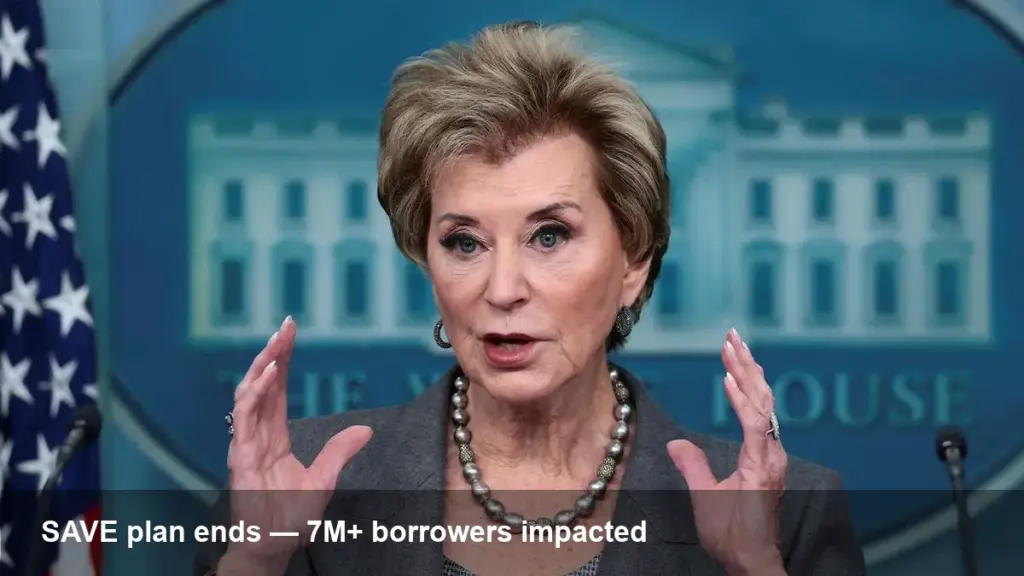

- Education Secretary Linda McMahon and Under Secretary Nicholas Kent say ending SAVE prevents taxpayer exposure to what they call an illegal policy.

- Borrowers enrolled in SAVE will have a limited time to pick a new repayment option; the FSA Loan Simulator can guide selections.

- Advocates warn the move will raise monthly payments and disrupt progress toward forgiveness; a new Rap plan is slated for 2026.

H2: What the Department of Education announced

The Trump administration’s Education Department on Tuesday unveiled a proposed joint settlement with Missouri that would terminate the Saving on a Valuable Education (SAVE) plan, a popular income-driven repayment option for federal student loans. The announcement follows a federal appeals court block of the program in 2024.

H3: Why officials say the plan is ending

Education Secretary Linda McMahon and Under Secretary Nicholas Kent called the SAVE plan an unlawful federal overreach and argued taxpayers should not be on the hook for student loan debt relief. McMahon posted on X: “The Biden Administration’s illegal SAVE Plan would have cost taxpayers … more than $342 billion over ten years. We won’t tolerate it.” (https://x.com/EDSecMcMahon/status/1998437896798224414?s=20)

H3: Who is affected

More than 7 million borrowers currently enrolled in SAVE would need to select a new repayment plan. The department said the Federal Student Aid (FSA) office will support borrowers through the transition and that the Loan Simulator tool can estimate monthly payments and help pick the best legal alternative.

H2: Reactions from borrower advocates

Student loan advocates warned the settlement could throw borrowers into confusion and higher costs. Michele Zampini of The Institute for College Access & Success said millions could face higher monthly payments and lose months of progress toward forgiveness. Persis Yu of Protect Borrowers called the settlement “pure capitulation,” saying it goes further than required and will raise costs for working people with student debt.

H2: Legal and legislative context

The SAVE plan was introduced by the Biden administration after the Supreme Court struck down Biden’s earlier debt-relief program in 2023. Several Republican-led states, including Missouri, sued over SAVE. A federal appeals court temporarily blocked the program in 2024; the new settlement would resolve those suits by ending SAVE.

H3: What comes next

Separately, the administration’s signature domestic bill — the One Big Beautiful Bill Act — includes a provision to replace current income-driven plans for loans disbursed on or after July 1, 2026. Under that proposal, SAVE and other IDR plans would be replaced by a standard repayment plan and a new Repayment Assistance Plan (RAP) starting July 1, 2026.

Borrowers currently on SAVE should monitor Department of Education notices, use the FSA Loan Simulator, and act quickly to choose a new repayment path once the department sets deadlines. The proposed settlement still must proceed through the legal and administrative steps before taking full effect.

Image Referance: https://abcnews.go.com/Politics/trump-administration-moves-end-major-student-loan-forgiveness/story?id=128268281